Drones & Insurance Inspections

If you’ve had damage to your property in the past that has required an insurance claim then you will no doubt be painfully aware of the waiting that is entailed while your claim is being processed through to a point when you can seek a resolution to the problems that you’re experiencing.

That’s not because the insurance companies are trying to avoid paying claims but rather that they’ve been slow to embrace new technologies that would enable them to process things faster. A storm that has damaged your home or business is likely to have caused damage across a wide area and so insurance companies can find themselves with a backlog of claims quite quickly at exactly the time that you are looking for a speedy answer to your problems.

Drones can provide an incredibly fast and accurate of completing the damage assessment part of the process so your loss adjuster has all the information that they need in order to make the decisions on your claim payout. However, this process still, more often than not, requires attendance on site by a person with all the necessary safety gear to make an assessment of some quite often difficult to reach areas. If the area, such as a roof, proves too awkward or dangerous to assess, then there can be more waiting while a third party with a cherry picker or scaffolding is sought out to complete the assessment. All the while, to take the example of a storm damaged roof, the water could be getting into your home and causing even more damage and distress.

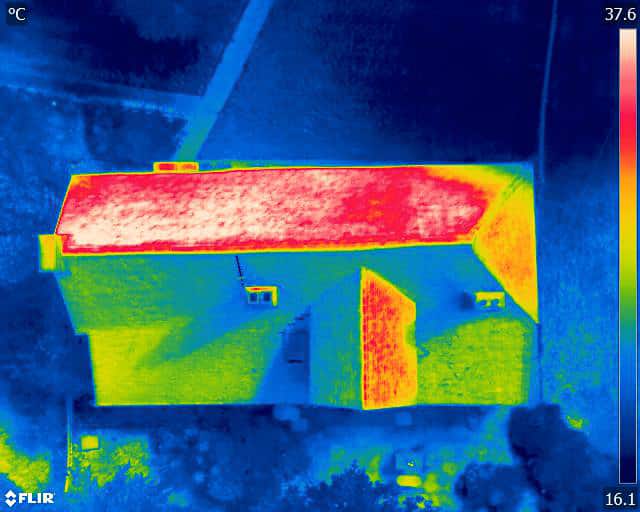

A UAV can be deployed from ground level and usually very quickly from the time of booking and detailed photography and video can be captured with no need to address the health and safety risks that come with working at height. Using a drone also means that you’re not risking more damage being caused during the inspection process and also you can reach otherwise inaccessible areas to obtain detailed imagery. Thermal imaging can also be carried out during the same visit to assess any water damage or hidden defects lying beneath the surface.

The pilot’s imagery can be transmitted directly to the loss adjuster who can remain at a central location to enable them to focus on assessing the damage from their desk and so processing claims faster – a relief I’m sure to everyone involved. Drone pilots can offer work directly with your insurer or be hired privately to provide a home or business owner with footage or photography of their property so they can see for themselves whether making a claim is the right route to take. If it isn’t, then you have excellent information to pass to maintenance companies about the exact nature of the repairs required.

Most properties can be assessed quickly and simply with only one or two drone flights. To find out more about how working with Drone Media Imaging can help you to resolve your insurance issues, then just get in touch and we are happy to discuss your requirements in detail.

Expert Infrared Inspections for Accurate Thermal Assessments

Need professional thermographic analysis for your project? Our certified experts use the latest infrared technology to deliver precise results. Contact Drone Media Imaging today for expert thermal imaging services.