Insurance Companies Embracing Drone Technology

Unlocking the Power of Drones: How Insurance Companies Can Benefit from Embracing Drone Technology

Insurance companies can greatly benefit from embracing drone technology. Drones have untapped potential and can be a perfect fit for partnerships with insurance loss adjusters. One area where this partnership can be beneficial is in claims assessment. Drones can quickly and accurately assess the extent of damage by capturing high-resolution images and videos of affected areas. This speeds up the claims processing and reduces human error. Drones can also be used for risk assessment and prevention by conducting aerial surveys of properties and identifying vulnerabilities. In post-disaster scenarios, drones can assess damage and help insurers allocate resources efficiently.

Despite these advantages, insurance companies have been slow to adopt drone technology, possibly due to initial investment and training costs, as well as concerns about privacy and data security. However, with proper regulations and ethical guidelines, these challenges can be addressed. The integration of drones into insurance operations can streamline processes, improve customer satisfaction, and increase efficiency. Insurance companies should recognise the value of drone technology and seize the opportunity to transform their industry.

Inspection Quotation - Get in Touch Today!

We are certified and approved drone pilots and work throughout the UK to provide aerial inspection surveys in both RGB and Thermal formats. We can produce survey grade photograpmmetry 2D orthomosaics of roofs, properties, farming, infrastructure and land areas following natural disasters such as flodding and wind damage. Fully insured and certified by the CAA with enhanced OSC permissions for day and night time flights.

Insurance companies can greatly improve their business processes by embracing drone technology. Despite drones not being a new concept, their untapped potential is vast. The ideal partnership between drone pilots and insurance loss adjusters seems like a perfect fit, making it puzzling why more companies have not taken advantage of this technology.

One area where the ideal partnership between drone pilots and insurance loss adjusters seems like a perfect fit is in the field of claims assessment. Traditionally, insurance adjusters have had to physically visit sites of accidents or disasters to evaluate the extent of damage. This process is time-consuming, costly, and often risky, especially in cases involving hazardous environments or hard-to-reach locations.

Drones can effortlessly navigate such challenging terrains, capturing high-resolution images and videos of the affected areas from various angles. By equipping these drones with advanced sensors and cameras, insurance companies can quickly and accurately assess the extent of damage, facilitating faster claims processing and minimising human error. This not only expedites the settlement process but also enhances the transparency and fairness of claim evaluations.

Moreover, drones can also aid in risk assessment and prevention. They can be deployed to conduct aerial surveys of properties, identifying potential vulnerabilities or hazards that may increase the likelihood of claims. This proactive approach allows insurers to offer personalised risk mitigation recommendations to policyholders, reducing the chances of future losses and ultimately benefiting both parties.

Furthermore, drones can play a crucial role in post-disaster scenarios. In cases of natural disasters, such as hurricanes or earthquakes, drones can be deployed to quickly assess the damage and help insurers prioritise their response efforts. This real-time data can enable insurers to efficiently allocate resources, provide timely assistance to affected policyholders, and streamline the overall claims management process.

Despite the evident advantages, it is puzzling why more insurance companies have not fully embraced drone technology. Perhaps the initial investment and training costs act as a deterrent, or there might be concerns regarding privacy and data security. However, with proper regulations and ethical guidelines in place, these challenges can be effectively addressed, ensuring the responsible and beneficial use of drones in the insurance industry.

The integration of drone technology into insurance company operations holds immense potential. By leveraging drones for claims assessment, risk prevention, and post-disaster response, insurers can streamline their business processes, enhance customer satisfaction, and improve overall efficiency. It is high time for insurance companies to recognise the value of this technology and seize the opportunity to transform their industry.

One supporting resource page on the internet for the integration of drone technology in insurance companies is “Drones in Insurance: A Game Changer” by Deloitte. This resource provides insights and case studies on how drones can revolutionise the insurance industry, specifically in claims assessment, risk prevention, and post-disaster response. It discusses the benefits, challenges, and considerations for insurance companies looking to adopt drone technology. The page also provides information on regulatory requirements, privacy concerns, and data security. Overall, this resource highlights the immense potential of drones in improving business processes and customer satisfaction in the insurance industry.

A helpful resource on the integration of drone technology in insurance is Deloitte’s “Drones in Insurance: A Game Changer,” which provides insights, case studies, and considerations for adopting drones. It also addresses regulatory requirements, privacy concerns, and data security, highlighting the immense potential of drones in the insurance industry.

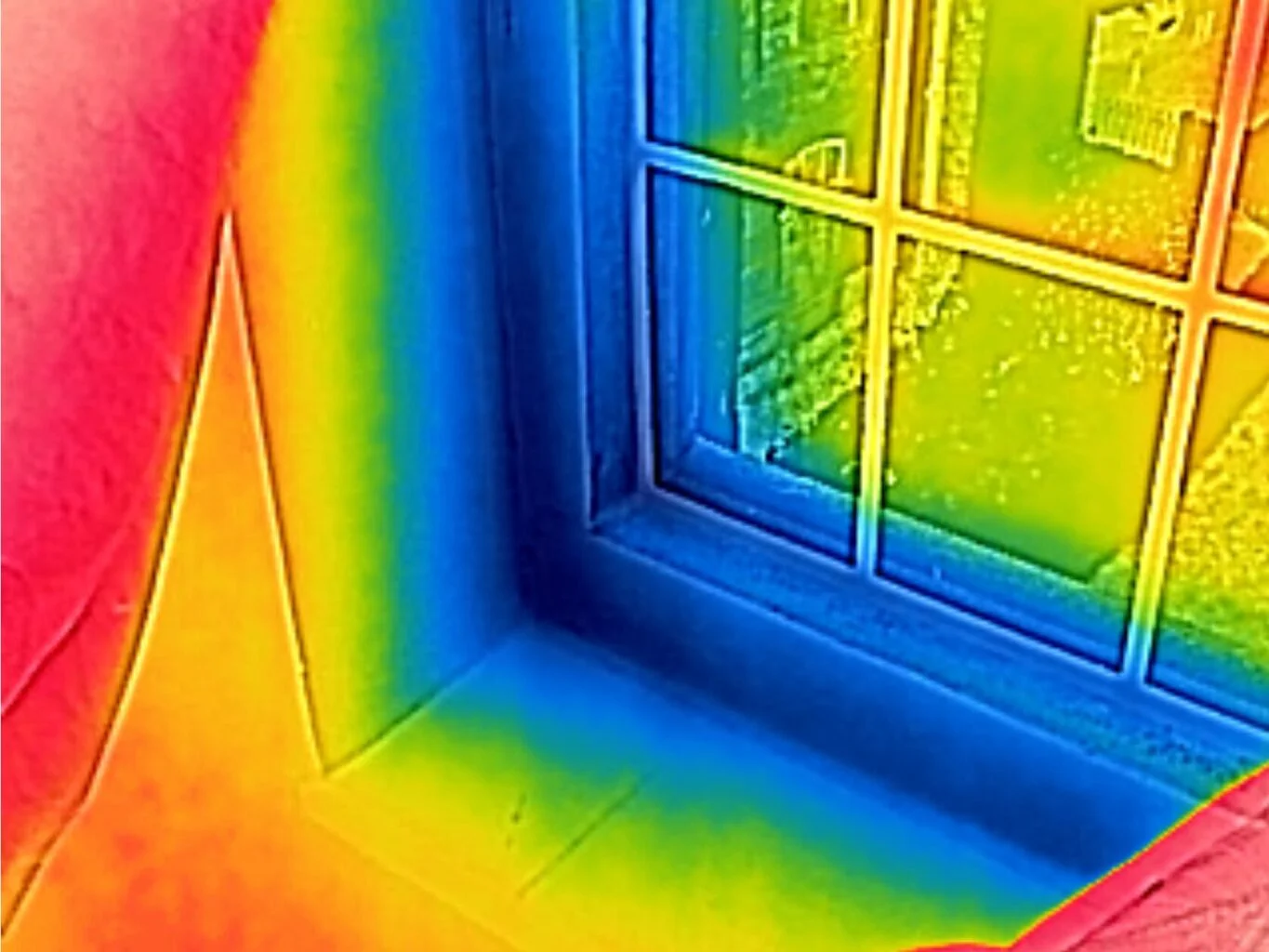

The Importance of Building Thermography Surveys in the UK and the Role of Level 3 Certified Thermographers Building thermography is a non-destructive diagnostic method that uses infrared technology to detect thermal anomalies in structures. In the UK, this approach has become critical for energy efficiency, structural integrity, and safety assessments, especially with rising environmental standards and compliance requirements like BREEAM (Building Research Establishment Environmental Assessment Method. Applications of Building Thermography Energy Efficiency Audits: Identifying heat [...]

Pinpointing energy loss in buildings involves identifying hidden insulation defects, thermal bridges, and air leaks. A Level 3 Thermographer employs advanced thermal imaging to ensure precise diagnostics and compliance with energy standards, providing property owners with detailed reports for informed energy efficiency improvements and cost savings.

A Level 3 Master Thermographer ensures precision, compliance, and cost savings in thermal imaging. Learn why their expertise is vital across industries like energy, construction, and manufacturing, and discover the tangible benefits of hiring a true professional in thermography.

Expert Infrared Inspections for Accurate Thermal Assessments

Need professional thermographic analysis for your project? Our certified experts use the latest infrared technology to deliver precise results. Contact Drone Media Imaging today for expert thermal imaging services.

related posts

Thermography, a non-invasive technique using infrared imaging, has emerged as a powerful tool in the building industry. It is particularly useful for investigating building air pressure, air flow, and inefficient air leaks. This article explores the application of thermography in these areas, providing valuable insights and practical examples.